Novated lease benefits

Are you missing out on the benefits of novated leasing?

A novated leasing program is a highly valuable employee benefit that demonstrates you have your staff’s best interests at heart. This uniquely Australian innovation is a smart and convenient way to help your employees purchase a car with the added bonus of maximising their tax savings.

Previously only available to large businesses, we are taking the hassle out of the novated lease for employers, so this workplace benefit is available to all employees no matter how small the organisation they work for.

Give employees a free payrise

Salary packaging reduces an employee's income tax, increasing take home pay at no cost to your company.

Attract and retain employees

A novated leasing program offers great financial benefits to current and future employees at no additional cost to you.

All the benefits without the responsibility

The primary responsibility for an employee's novated lease rests with the employee. If the employee departs from the company, the novated lease also terminates.

Decrease payroll tax

Adding a novated leasing program lowers your company's gross wage bill which reduces payroll tax.

Electric vehicle discount

Your quick guide to electric vehicle discounts

What is the electric vehicle discount?

The electric vehicle discount aims to reduce emissions from traditional vehicles by offering financial incentives to people who buy electric vehicles.

Makes electric cars more affordable

Available to employees through a novated lease

Employers help employees and the planet

How does the electric vehicle discount work?

Makes eligible electric cars exempt from fringe benefits tax (FBT)

Novated lease is paid for with 100% pre tax dollars

Novated lease benefits for employees

Enhance Employee financial wellness

Significant savings are possible when buying an electric car through a novated lease

Boost your employee value proposition

Greener-friendly perks tailored to today's workforce

Make going green easy

Have a positive impact on the environment and save with the electric vehicle discount

Novated lease benefits for employees

Enhance Employee financial wellness

Significant savings are possible when buying an electric car through a novated lease

Boost your employee value proposition

Greener-friendly perks tailored to today's workforce

Make going green easy

Have a positive impact on the environment and save with the electric vehicle discount

Employer’s guide to novated lease benefits

How does a novated leasing program work?

How does a Novated Leasing program work?

Activating a novated leasing program with Novated Choice

Our novated leasing program is a hassle-free way for employers to help employees manage their personal vehicles through salary sacrificing.

We do all the legwork

We help employees choose their ideal car, handle the financing, and bundle all running costs into one fixed budget. We then send a bill for this complete car package to employers who deduct the expenses from their employees salary.

This three-way agreement between Novated Choice, the employer, and the employee benefits everyone. Employees see a reduction in their taxable income, pay less income tax, and the company's payroll tax decreases. Everyone wins!

We specialise in small and medium business

The team at Novated Choice learnt all the ins and outs of novated leasing through years of working with corporations and government entities. We now bring these same big business benefits to smaller businesses, something we are passionate about as a small business ourselves!

How does novated leasing support our employee value proposition?

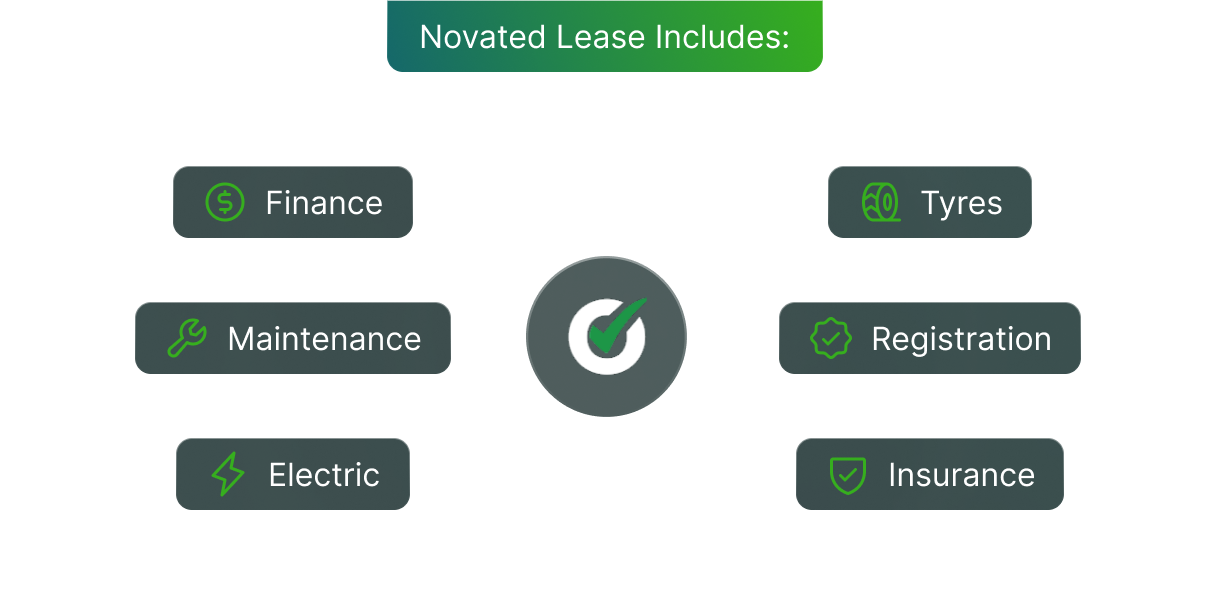

When your employee chooses to enter a novated lease agreement for a new, used or electric vehicle, they cover the costs through regular deductions from their salary.

But novated lease benefits extend beyond just taxation savings on the initial purchase of the vehicle. It bundles in other vehicle and operational costs like stamp duty, registration, insurance, fuel, tyres, and maintenance, providing even bigger reductions in taxable incomes and greater benefits to your employees.

Is there a cost to our business for a novated leasing program?

No! All you as an employer need to do is help us set up the novated lease in your payroll and include the lease as part of your BAS and FBT reporting. All costs and fees associated with novated leasing are the responsibility of your employee.

Process

How to create your own novated leasing program

-

1

Employer onboarding and deductions

Simply fill out the employer sign up form that confirms you will be deducting novated lease payments on behalf of your employee during their employment with you. We will send you an invoice per employee pay cycle detailing the amount of the deduction you need to make. It’s that easy!

-

2

Employee set-up

For each employee who participates in the program, we supply you with personalised pre-tax and post-tax deductions to input into your payroll system. We can adapt to your current system, including, but not only, Xero, MYOB, Microkeeper QuickBooks. All you have to do is enter the information we provide and you're all set.

-

3

Payment Methods

Simply schedule novated lease payments on behalf of your employee through direct debit or Electronic Funds Transfer (EFT). These payments can be set up to align with your regular pay cycle for added convenience. If you opt for direct debit, the only additional step needed is for you to sign the standard direct debit terms and conditions. It's as simple as that.

Beyond the Basics

Novated Choice employer guide to novated leasing & Program Inclusion

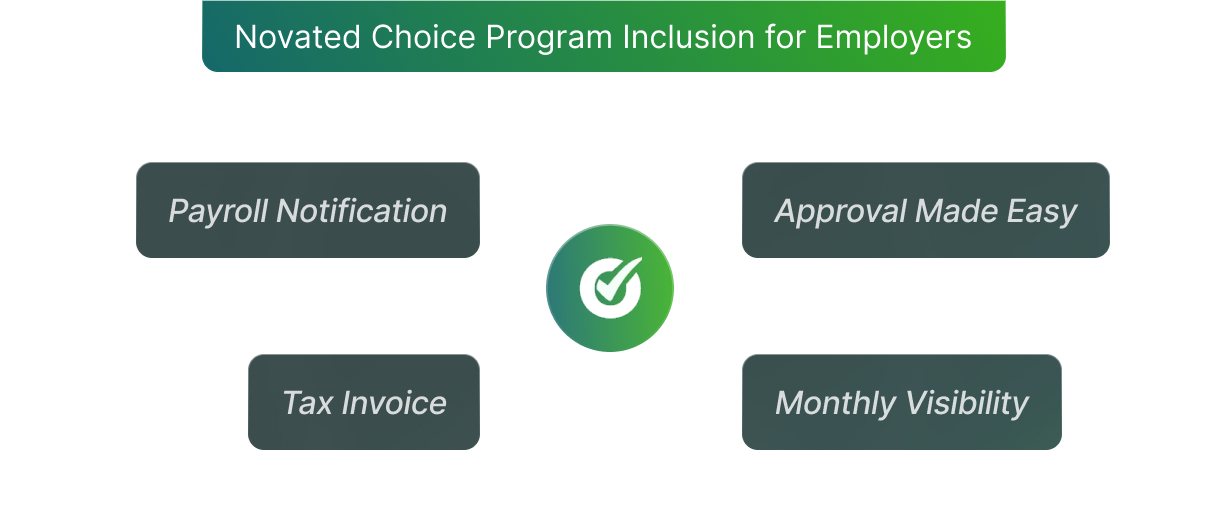

Payroll, reporting & approvals made easy

Payroll notification: Once a novated lease is activated we provide you with a payroll notification so you can set up and manage payroll deductions effortlessly

Tax Invoice: Novated Choice knows not all tax invoices are the same. We provide all necessary details to maintain a harmonious relationship between payroll and accounts payable

Stay in the loop: Each month, we can share reports to give you a snapshot of lease progression and the novated leasing program overall

Approval made easy: Say goodbye to paperwork! Approving an employee for a lease is as simple as a few clicks.

Simplify lease endings and Fringe Benefits Tax (FBT) with clear notifications and easy reporting

Lease conclusion or employee departure: When a lease ends or an employee leaves, you receive a brief termination notification, streamlining payroll procedures

Annual Visibility: Receive a fringe benefit report at the conclusion of each FBT year to ensure you've successfully offset any liabilities.