Upcoming Novated Lease Tax Changes and Their Impact

If you have a novated lease or you are thinking about getting one, there are some novated lease tax changes coming that could shake things up. The government has been tweaking the rules to encourage cleaner, more efficient cars, and these changes could mean big savings or a different way of managing your lease. But what exactly is changing, and how will it affect you?

Tax rules around novated leases have changed before, remember when, from 1 July 2022, employers no longer had to pay Fringe Benefits Tax (FBT) on eligible electric cars and running costs? That was a huge win for EV drivers. Now, with more updates on the way, it is important to stay in the loop. Even if you drive an electric, a plug-in hybrid, or a regular petrol car, these changes could impact how much you pay. Let’s know exactly what to expect.

What’s Inside:

- Novated Leasing Tax Benefits

- Upcoming Novated Lease Tax Changes and Their Impact

- Navigating Lease Modifications Post-Tax Changes

- Novated Lease Tax Changes: Make Your Move Now

Novated Leasing Tax Benefits

A novated lease is a popular vehicle financing option in Australia that allows you to lease a car through a three-way agreement between you, your employer, and a finance company.

This arrangement enables you to make lease payments from your pre-tax salary, reducing your taxable income and offering several financial advantages.

Goods and Services Tax (GST) Savings

With a novated lease, there’s an up-front GST discount on your vehicle (up to $6,334 for 2024-2025 financial year). This alone can result in significant savings, especially when leasing a brand-new vehicle. Plus, running costs like fuel, insurance, and servicing are also GST-free, further reducing your expenses.

Lower Running Costs

Your vehicle expenses are bundled into the lease and paid from your pre-tax salary. This not only makes budgeting easier but also reduces your taxable income, lowering the amount of tax you pay each year.

Fringe Benefits Tax (FBT) and EV Exemptions

Novated leases are subject to Fringe Benefits Tax (FBT), but it is managed for you through a post-tax deduction, so there are no surprises at tax time. If you are considering an electric vehicle (EV), there is even better news, eligible EVs are exempt from FBT, giving you even more savings.

Residual Value and Flexibility

At the end of your lease, you have options. You can pay the residual value to keep the car, release it, or even sell it, if you make more than the residual, the profit is yours to keep. This flexibility means you can upgrade to a new vehicle every few years while continuing to maximise tax benefits.

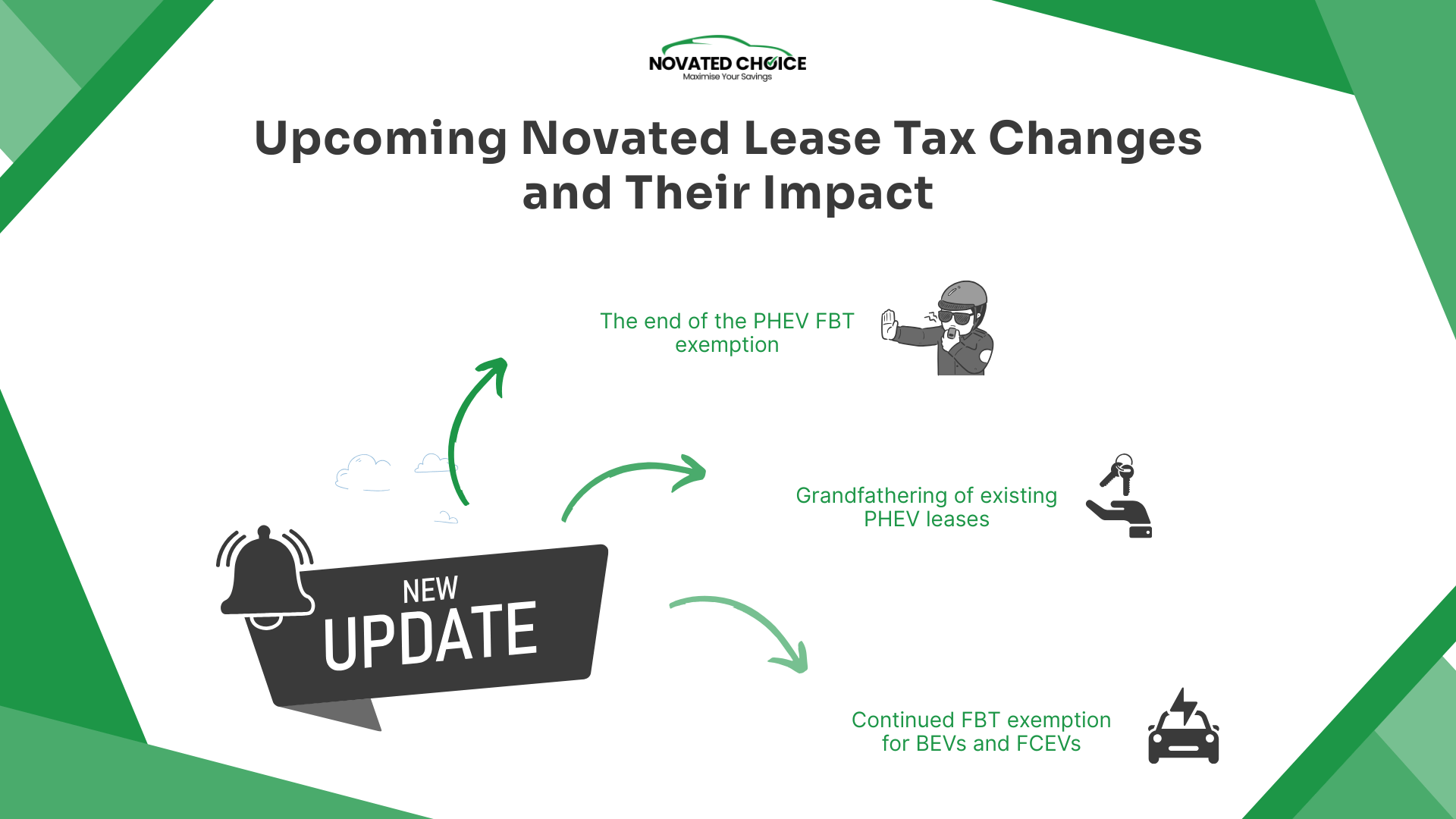

Upcoming Novated Lease Tax Changes and Their Impact

If you are considering a novated lease in Australia, it is important to stay informed about the upcoming novated lease tax changes in 2025 that could affect your decisions. Here's what you need to know:

The End of the PHEV FBT Exemption

As of 1 April 2025, PHEVs will no longer qualify for the FBT exemption. This means that any new novated leases for PHEVs entered into after this date will attract FBT, meaning there will now be a post-tax deduction to offset the FBT.

Grandfathering of Existing PHEV Leases

If you have an existing novated lease for a PHEV that commenced before 1 April 2025, you will continue to benefit from the FBT exemption until the end of your lease term. However, it is important to avoid any modifications to your lease agreement after this date, as changes could result in the loss of the exemption.

Continued FBT Exemption for BEVs and FCEVs

The FBT exemption will remain in place for BEVs and FCEVs beyond 1 April 2025. This ongoing incentive aims to encourage the adoption of fully electric and hydrogen-powered vehicles, offering potential tax savings for those considering these options.

Impact on Lease Modifications and Employment Changes

Be aware that any alterations to your lease agreement, such as refinancing, extending the lease term, or adding accessories that affect the vehicle's value, could nullify the FBT exemption. Changes in employment may impact your eligibility for the exemption, so it is essential to consult with your employer or leasing provider before making any decisions.

Navigating Lease Modifications Post-Tax Changes

Not all modifications will affect your FBT exemption status. Adjustments that do not change the financial obligations under the lease, such as modifications to the lease budget for maintenance or running costs as contemplated by the original fully maintained lease agreement, are generally permissible and will not cause the FBT exemption to cease.

- Review your lease agreement - Understand the terms and identify any potential areas that might require modification

- Plan ahead - If you are considering any changes to your lease, aim to implement them before 1 April 2025 to retain the FBT exemption.

- Consult professionals - Seek advice from your leasing provider or a financial advisor to ensure that any planned modifications won't inadvertently affect your tax benefits.

Novated Lease Tax Changes: Make Your Move Now

Tax changes are coming, but that doesn’t mean you have to pay more. With the right novated lease setup, you can still maximise your savings and keep more money in your pocket. Novated Choice will always make sure that you are not caught off guard, we will help you navigate these changes with ease.

Don’t wait until it’s too late. The best way to stay ahead is to plan now. Novated Choice is here to guide you through every step, ensuring you get the most out of your novated lease. Let’s secure the best deal for you, chat with us today, and drive smarter tomorrow.