Tax Savings on a Novated Lease: How Much Can You Save?

When it comes to car finance, the true cost can often feel like an iceberg, what you see above the surface barely scratches the depth of what lies beneath. Loan repayments, interest rates and ongoing expenses can quickly add up, leaving many drivers submerged in hidden costs. However, there is a way to reduce your financial burden while still driving the car you want. One of the most effective strategies is leveraging tax savings on a novated lease, a solution that combines convenience with compelling financial benefits.

A novated lease is an agreement between you, your employer, and a finance provider, allowing you to lease a car using pre-tax income. This not only reduces your taxable income but can also lower the overall cost of owning a vehicle. Let's explore how a novated lease works and break down the potential tax savings to help you determine if it is the right fit for your financial goals.

What’s Inside:

- The Rising Costs of Vehicle Ownership in Australia

- Why a Novated Lease Could Be the Smartest Way to Own a Car in Australia

- Tax Savings on a Novated Lease: How Much Can You Save?

- Potential Tax Savings from Novated Leasing

- Maximise Your Tax Savings on a Novated Lease with Novated Choice

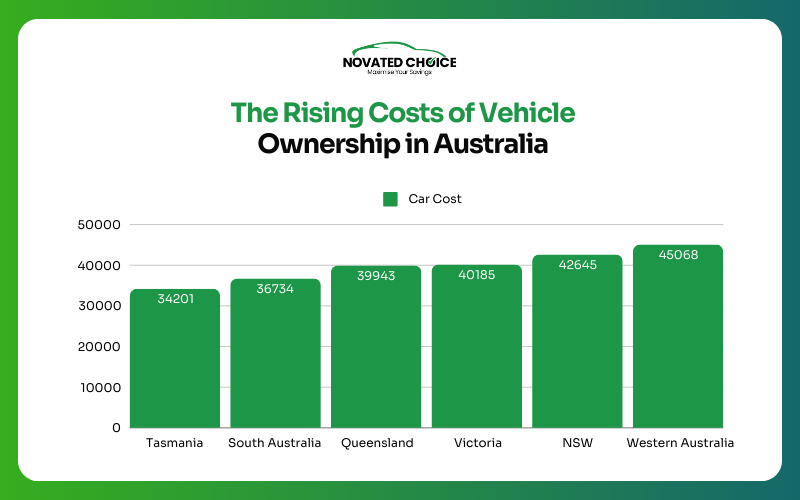

The Rising Costs of Vehicle Ownership in Australia

The rising costs of vehicle ownership in Australia are becoming a significant financial burden for many households. In 2024, owning a car now costs between $10,000 and $25,000 annually. Car costs also vary depending on where you live.

On average, vehicle prices differ from state to state, with Tasmania seeing the lowest at $34,201, and Western Australia at the highest, with an average of $45,068. The cost of owning a car is rising nationwide because of increasing registration, insurance, maintenance, and fuel costs.

Why a Novated Lease Could Be the Smartest Way to Own a Car in Australia?

A novated lease can be one of the smartest ways to own a car in Australia, especially if you are looking to save money and make car ownership more affordable. It is a simple arrangement where you, your employer, and a leasing company work together. Your employer facilitates the lease payments through salary packaging, typically deducting them from your pre-tax income. There may be a post-tax component depending if the car is petrol but if it is fully electric then the deductions are all pre-tax.

Why does this matter? By paying for the car with pre-tax dollars, you Are effectively lowering your taxable income, which can result in tax savings. This means you could pay less tax, and that can make a real difference to your take-home pay.

Tax Savings on a Novated Lease: How Much Can You Save?

A novated lease is a popular vehicle financing option in Australia, especially for employees looking to reduce their tax liabilities and manage car-related expenses more efficiently. But how exactly does a novated lease offer tax savings? Let’s break it down:

How Does a Novated Lease Offer Tax Savings?

Salary packaging

One of the primary ways a novated lease offers savings is through salary packaging. With this arrangement, some or all lease payments and running costs are deducted from your pre-tax income.

This means you are effectively reducing your taxable income, which can lower the amount of tax you pay. The more you can package, the greater the potential savings.

GST savings

A novated lease can help you save on Goods and Services Tax (GST). If you lease the vehicle through a novated lease, GST is excluded from the financed amount and the running costs. This can mean a significant reduction in the overall cost of the vehicle, especially if you're purchasing a new car.

Running costs

The running costs of the vehicle, such as fuel, insurance, registration, and maintenance, can be included in the lease agreement. These costs are also typically paid from your pre-tax income, which can further reduce your taxable income. In turn, this helps lower your overall tax burden and makes it easier to manage your vehicle-related expenses.

Fringe benefits tax (FBT)

While novated leases are subject to Fringe Benefits Tax (FBT), this is managed for you via a post-tax deduction so you wont need to fret about coming up with the money at the end of the FBT year. If your car is a full electric there is the further benefit of not having to pay FBT provided it meets the required criteria.

Residual value

At the end of the lease, there is a residual value, the amount you pay to purchase the car outright or settle the lease. However you can choose to re-lease the same car to keep enjoying the benefits or you can sell the car if you get more than the residual then it is yours to keep and get yourself into a new car. It is a great way to turn your car around every few years.

Key Factors Influencing Tax Savings on a Novated Lease

Your savings on a novated lease depend on several factors. Some of the most important include:

Income level

Higher-income earners may see greater tax savings due to the higher tax rates they are subject to. Salary packaging your car costs reduces your taxable income, so the more you earn, the more significant the savings on your tax bill.

Car choice

The type of car you choose can have an impact on your savings. Luxury cars with higher purchase prices will have higher running costs, which means more of your pre-tax salary can be used to cover the lease payments. On the other hand, choosing a more economical vehicle can reduce your overall package cost and the impact of FBT.

Lease term & structure

The term of the lease and the residual value affect your monthly payments. A longer lease term with a higher residual value will generally reduce your monthly lease payments, but it may increase your final balloon payment.

To Get an Accurate Estimate of Your Potential Tax Savings, Consider:

Use a novated lease calculator

Our easy-to-use calculator helps you find the ideal vehicle while estimating potential weekly savings, empowering you to make smart financial choices before you begin your car search. It only takes a few details to see how a novated lease can affect your take-home pay and lower your taxable income.

Consult a financial advisor

For personalised advice, speaking with a financial advisor like Novated Choice is a smart move. They can assess your unique financial situation and help you maximise the benefits of a novated lease, ensuring it aligns with your long-term goals.

Potential Tax Savings from Novated Leasing

When considering a novated lease, it is important to understand how the potential tax savings work, as they don't always align directly with the weekly lease payments. Take the 2024 Volvo XC40 Recharge Pure as an example, it has the highest weekly pricing at $255, but its annual tax savings reach an impressive $9,516.

On the other hand, the 2024 MG HS Plus EV Excite, with a lower weekly payment of $199, offers tax savings of $5,087 annually. This demonstrates that the relationship between weekly lease costs and tax savings isn't always linear. It's the vehicle's total running costs, including fuel, maintenance, and depreciation, that determine the final tax savings, not just the lease payment itself.

The key is to focus on the overall tax benefits and consider how the vehicle’s other costs are structured, rather than just comparing the weekly payments. Novated leasing offers a great opportunity to reduce your taxable income, but it is the total package, including how the vehicle fits into your lifestyle and financial situation, that will provide the most value.

Maximise Your Tax Savings on a Novated Lease with Novated Choice

Take the first step to a smarter way to manage your car expenses while maximising your tax savings. With tax savings on a novated lease, you can reduce your taxable income by bundling car payments, maintenance costs, and other expenses into one simple salary package.

Ready to start saving? Novated Choice is here to help you navigate the process and determine how much you could save with a novated lease. Don't miss out on the opportunity to make your car more affordable and your tax obligations lighter. Get in touch with us today to explore your options and start your journey toward potential tax savings on a novated lease.